Hello!

info@cyrusmcs.com

+233 553 179 240

Achieving poverty reduction through affordable microcredit services

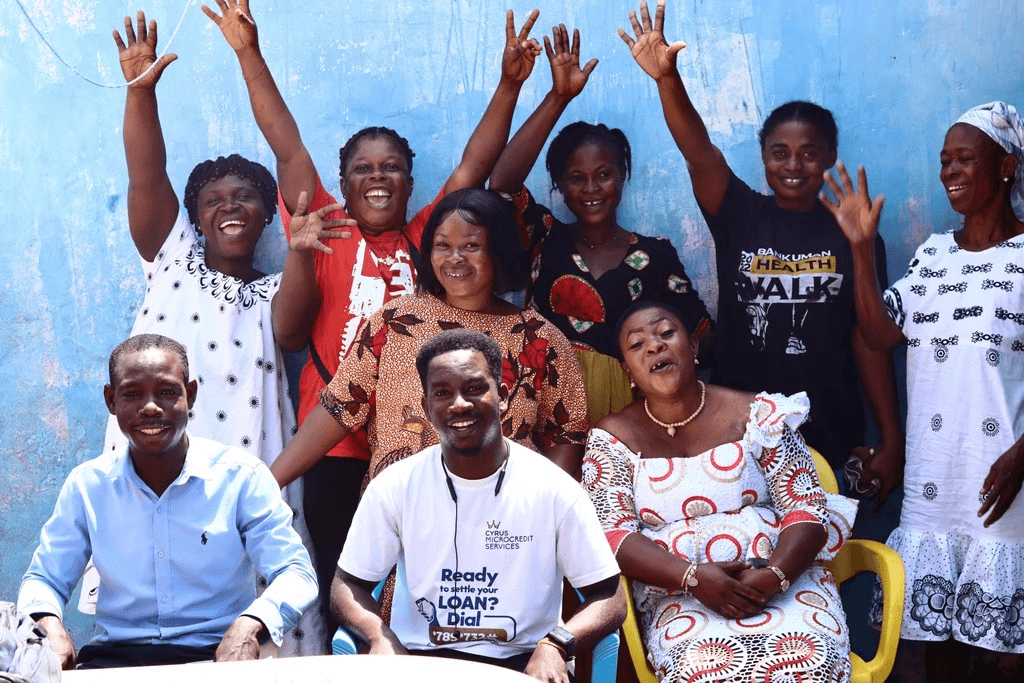

Impact

Join the community of businesses and individuals who trust us to meet their financial needs.

Our Client-Centric Approach.

We Promise Sustainable Future For You..

Loans are very small, short term, and unsecured, with more frequent repayments.

The screening process ensures that the applicants are micro borrowers

The applicants are then registered after they pass the screening stage.

Loan documentation is generated largely by the Loans and Operations managers through visits to the borrower’s business and home

Loan Repayment Process

Dial 789731# on your phone.

Select "Loan Repayment".

Enter your loan account number.

Enter the repayment amount.

Confirm the details and submit.

Receive a confirmation message.

Empowering Small Businesses

As an MFI, CYRUS was formed with the purpose of providing social and financial solutions to the poor. To determine its vulnerability to credit risk, there is review of the policies and procedures at every stage in the lending process to determine whether they reduce delinquencies and loan losses to an acceptable level.

These policies and procedures include the loan eligibility criteria, the application review process and authorization levels, collateral or security requirements, as well as the “carrots and sticks” used to motivate staff and compel borrowers to repay.

Screening Process

The screening process ensures that the applicants are micro borrowers. CYRUS caters for low-income clients, both the underemployed and the entrepreneurs with an often informal family business (eg petty traders, vegetable farmers etc).

Registration of Applicants

The applicants are then registered after they pass the screening stage. The details taken include names, gender, business location, residential address, occupation type, phone number and name of spouse or next of kin.

Credit risk analysis

Loan documentation is generated largely by the Loans and Operations managers through visits to the borrower’s business and home. Directions to the residences are also drawn up for verification.

Credit approval

CYRUS has a highly decentralized process; hence credit approval by the field level staff depends heavily on the skill and integrity of loan officers and managers for accurate and timely information.

Training

Applicants whose loans have been approved are then trained in Basic Financial Management. They are trained to distinguish between working capital and profit, in basic customer service and to inculcate in them the habit of savings

Building a Brighter financial Future & Good Support.

We maintain full transparency in all our dealings to ensure you always know what to expect.

Our advanced encryption technology keeps your financial information safe and secure.

With a decade of experience, our successful history speaks volumes about our reliability and commitment.

Success Stories

Got questions? we’ve got you covered.

What is Cyrus MicroCredit Services

CYRUS MICROCREDIT is a microfinance institution (MFI) dedicated to providing social and financial solutions to the poor, helping them access credit and improve their livelihoods.

What is the loan application process at CYRUS?

The loan process at CYRUS involves submitting an application, undergoing a review of credit risk and financial stability, and receiving a loan decision. Detailed procedures are in place to ensure transparency and fairness.

How do i repay my loan

Visit our nearest office or dial 789732# for assistance with the loan repayment process.